In the ever-evolving world of cryptocurrencies, the mining rig stands as a critical pillar for enthusiasts and investors alike. As the price of Bitcoin continues to fluctuate wildly, understanding the financial implications of mining rig prices is increasingly essential. What does it take to make a wise investment in this arena where technology and finance intersect? Here, we’ll decode the complexities of mining rig prices to assist you in maximizing your returns.

Mining machines, specifically designed to solve complex mathematical problems that secure cryptocurrency networks, are sought after by both individual miners and large-scale operations. Essentially, they are the engines that drive the mining process, particularly for popular cryptocurrencies like Bitcoin, Ethereum, and even Dogecoin. The choice of a mining rig can significantly affect mining efficiency and profitability, making the understanding of various price points crucial for prospective buyers.

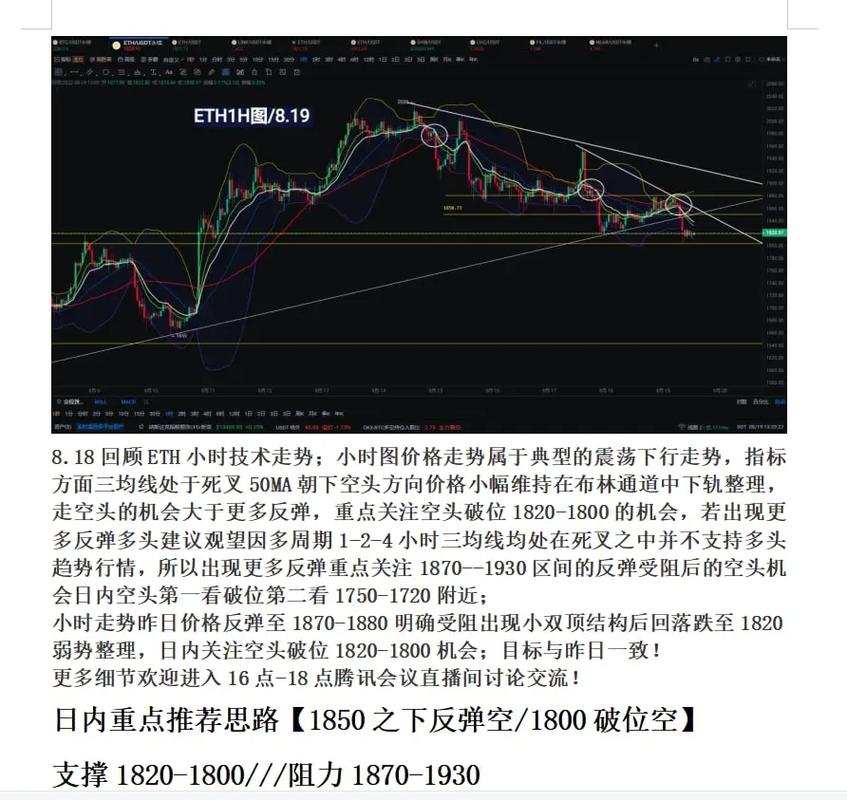

Ethereum, for example, has become a focal point of attention within the mining community. With the Ethereum network transitioning to a proof-of-stake model, the specifics of mining equipment and its pricing take on added significance. Investors want to determine the longevity of their investments against the backdrop of an evolving market landscape. Affected by this transition, the price of ASIC miners has seen fluctuations that can sometimes leave investors scratching their heads.

For those considering entering this space, the allure of Bitcoin remains irresistible. Its market cap boasts staggering numbers, yet those interested must decipher the best approach to acquiring mining rigs. Factors such as electricity costs, cooling solutions, and even hosting services come into the equation, each impacting the overall viability of an investment. A considerable part of the expense is not only the hardware itself but also operational overheads that may potentially eat into profits.

The notion of mining machine hosting complicates matters further. Hosting services alleviate the burden of running mining operations at home, providing the necessary infrastructure and maintenance. However, such services often have their own unique pricing structures. Understanding the service level agreements and associated fees becomes paramount for optimizing profitability. Amid these cornucopia of choices, one can easily lose sight of what constitutes a worthwhile investment.

When you set your sights on acquiring a mining rig, you’ll encounter a diverse array of hardware. Each miner is designed with specific functionalities that can determine their efficiency in different cryptocurrency markets. While some rigs are built exclusively for Bitcoin, others can mine multiple currencies, offering flexibility amidst shifting trends. The varied structures and associated costs allow for strategic planning, catering to investors with diverse portfolios.

As the cryptocurrency ecosystem continues to burgeon, market dynamics influence not just the price of coins but also the demand for mining rigs. The market is punctuated with a series of highs and lows, driven by news cycles, regulatory clarifications, and technological advancements. Consequently, a prudent investor must stay informed, adapting quickly to these changes, and discerning when to buy or sell their mining equipment. One must ask, is this the right moment to invest, or should you wait for the next big market shift?

This strategic decision-making extends beyond just individual miners; it filters into the collective operations of mining farms. These often house a vast array of rigs, designed collaboratively to maximize output and minimize costs. Here, understanding operational costs against mining returns is essential. Mining farms also attract significant interest from investors who may want to dip their toes into a diversified investment without the hassle of managing equipment personally.

In wrapping up this exploration of mining rig prices, it’s evident that these machines represent more than a mere entry point into the crypto space. They signify a gateway to a vibrant community driven by technology, innovation, and investment potential. As you consider your place within this fascinating world, remember that every decision regarding which rig to acquire or how to approach hosting will shape your journey ahead.

Ultimately, the best investment guide will provide insight into both the present conditions and future trends of mining operations. Whether you are eyeing Bitcoin, Ethereum, or others in the crypto spectrum, the key is to remain adaptable, informed, and ready to make strategic choices as the market continues to evolve.

A wild ride through GPU shortages and crypto dreams! This guide cuts through the noise, revealing hidden costs and ROI realities. Essential for serious miners, but proceed with caution – volatility ahead!