Nigeria, a nation teeming with entrepreneurial spirit and a burgeoning tech scene, is rapidly becoming a hotbed for cryptocurrency adoption. While direct Bitcoin buying and selling are complex due to regulatory landscapes, the demand for Bitcoin mining machines and hosting services is undeniably on the rise. This comprehensive guide delves into the world of securing cutting-edge Bitcoin mining machine deals within Nigeria, navigating the nuances of the market, and understanding the potential pitfalls and rewards.

The allure of Bitcoin mining lies in the potential to earn cryptocurrency by validating transactions on the blockchain. However, setting up a mining operation isn’t as simple as plugging in a computer. It requires specialized hardware – Application-Specific Integrated Circuits (ASICs), or mining machines – that are designed specifically for the computationally intensive task of solving complex cryptographic puzzles. These machines come with hefty price tags, and their efficiency is constantly evolving, making the selection process crucial.

Understanding the Bitcoin mining machine landscape is paramount. Popular models like the Antminer S19 series, Whatsminer M30S++, and AvalonMiner series are often sought after. Each machine has different hash rates (a measure of its processing power), power consumption, and efficiency. A higher hash rate means a greater chance of solving blocks and earning Bitcoin, but it also means higher electricity costs. Therefore, a careful cost-benefit analysis is essential, taking into account the prevailing electricity rates in Nigeria. Regions with cheaper electricity are, naturally, more attractive for mining operations. The initial investment in the hardware is a significant barrier to entry for many, but the potential return on investment is what fuels the demand.

Sourcing reliable suppliers for Bitcoin mining machines in Nigeria can be challenging. While some local vendors exist, many miners import directly from manufacturers or authorized distributors in China or other countries. It’s critical to verify the authenticity of the equipment and ensure it meets the advertised specifications. Scamming is a real concern, and due diligence, including background checks and escrow services, is highly recommended. Participating in online forums and communities dedicated to Bitcoin mining can provide valuable insights and help identify reputable suppliers. Consider joining local cryptocurrency groups within Nigeria to network and learn from the experiences of others. This can also help in identifying potential group buying opportunities, which could lead to lower prices. Furthermore, understand the customs regulations and import duties that apply to mining equipment in Nigeria to avoid unexpected costs.

For those who prefer not to manage their own mining infrastructure, mining machine hosting services offer a viable alternative. Hosting providers operate data centers specifically designed for mining, providing the necessary power, cooling, and security. By outsourcing the technical aspects of mining, individuals can focus on earning Bitcoin without the hassle of maintaining equipment. Several hosting providers cater to the Nigerian market, either operating directly in Nigeria or offering services remotely. When selecting a hosting provider, consider factors such as the uptime guarantee, security measures, electricity costs, and reputation. It’s also important to understand the hosting agreement’s terms and conditions, including the fee structure and dispute resolution mechanisms. Look for providers that offer transparent reporting and monitoring tools so you can track the performance of your mining machines.

Beyond Bitcoin (BTC), other cryptocurrencies like Ethereum (ETH), Dogecoin (DOGE), and Litecoin (LTC) can also be mined, though they often require different types of mining hardware or have transitioned to Proof-of-Stake mechanisms rendering GPU mining obsolete. While Bitcoin mining remains the most popular option, exploring alternative cryptocurrencies can offer diversification and potentially higher returns, depending on market conditions. Always conduct thorough research before investing in mining any cryptocurrency, considering its market capitalization, trading volume, and future prospects.

The regulatory environment surrounding cryptocurrencies in Nigeria is constantly evolving. While the Central Bank of Nigeria (CBN) has previously issued directives restricting banks from facilitating cryptocurrency transactions, the overall sentiment towards blockchain technology is becoming more positive. It’s crucial to stay informed about the latest regulations and policies to ensure compliance and avoid legal issues. Seek legal advice from professionals specializing in cryptocurrency law to navigate the complexities of the regulatory landscape. Engagement with regulatory bodies and participation in industry advocacy groups can help shape future policies that are conducive to the growth of the cryptocurrency ecosystem in Nigeria.

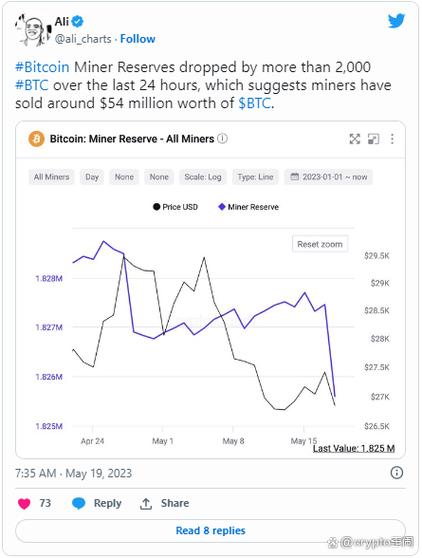

Finally, remember that Bitcoin mining is a high-risk, high-reward venture. The price of Bitcoin is volatile, and the profitability of mining can fluctuate significantly. Before investing in mining machines or hosting services, conduct a thorough risk assessment and understand the potential downside. Consider factors such as the difficulty of mining, the electricity costs, and the price of Bitcoin. Diversifying your investments and not putting all your eggs in one basket is always a prudent strategy. Continuously monitor the performance of your mining operation and adjust your strategy as needed. Staying informed about the latest developments in the cryptocurrency market and adapting to changing conditions are key to success in the long run. The future of Bitcoin mining in Nigeria is bright, but it requires careful planning, diligent execution, and a healthy dose of risk management.