Navigating the tumultuous seas of cryptocurrency investing can feel like charting a course through a perpetual storm. Fortunes are made and lost on the whims of market sentiment, regulatory shifts, and technological advancements. But beneath the surface of daily price fluctuations lies a fundamental layer of infrastructure – the mining network. Investing in mining machinery, specifically, presents a unique opportunity to participate in the backbone of the decentralized digital economy. But it’s not a simple path. Understanding market price fluctuations of these machines is paramount to success, transforming what appears as chaotic noise into a discernable symphony of opportunity.

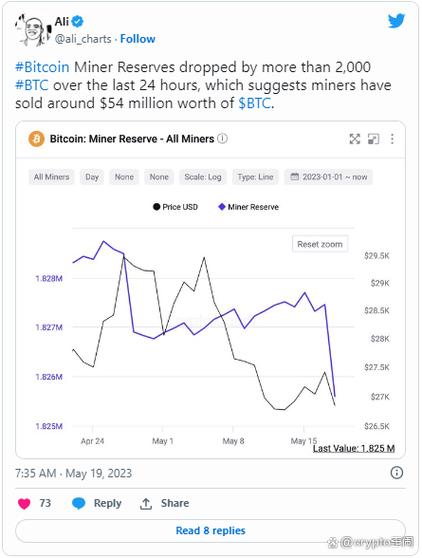

Bitcoin, the granddaddy of cryptocurrencies, operates on a Proof-of-Work (PoW) consensus mechanism. This system necessitates a vast network of specialized computers – mining rigs – to solve complex cryptographic puzzles, thereby validating transactions and securing the blockchain. The difficulty of these puzzles adjusts dynamically, influencing the profitability of mining. When Bitcoin’s price surges, the demand for mining machines explodes, driving up their market value. Conversely, a prolonged bear market can lead to a glut of used equipment flooding the market, depressing prices. This delicate dance between cryptocurrency price and mining hardware value forms the core of the investment challenge.

Beyond Bitcoin, a multitude of other cryptocurrencies rely on mining. Ethereum, while transitioning to Proof-of-Stake (PoS), previously relied heavily on mining, creating a vibrant market for GPU-based mining rigs. Even Dogecoin, the meme-inspired cryptocurrency, leverages a merged-mining mechanism with Litecoin, impacting the demand for specific types of mining hardware. Each cryptocurrency presents a unique mining algorithm and economic model, influencing the suitability and profitability of different mining machines. Understanding these nuances is crucial for informed investment decisions.

Mining machine hosting services further complicate the equation. Many investors opt to delegate the operational aspects of mining to specialized facilities, known as mining farms. These farms provide the infrastructure – power, cooling, and internet connectivity – necessary to run mining rigs efficiently. The cost of hosting, however, eats into the profitability of mining. Factors like electricity rates, maintenance fees, and the farm’s geographical location play a significant role in determining the overall return on investment. Choosing a reputable hosting provider with competitive rates is essential for maximizing profits.

The secondary market for mining machinery introduces another layer of complexity. As newer, more efficient machines enter the market, older models become obsolete, losing their competitive edge. The price of used mining rigs can fluctuate dramatically depending on their age, condition, and the current profitability of mining. Savvy investors can often find undervalued machines in the secondary market, but careful due diligence is required to assess their remaining lifespan and potential performance.

Furthermore, the development of new mining technologies can disrupt the market. The introduction of more powerful and energy-efficient Application-Specific Integrated Circuits (ASICs) can render older ASICs obsolete almost overnight. These technological leaps often trigger price drops in older generation hardware. Staying informed about the latest advancements in mining technology is crucial for avoiding the pitfalls of investing in outdated equipment.

Successfully investing in mining machinery requires a multifaceted approach. It demands a deep understanding of cryptocurrency markets, mining algorithms, hardware specifications, and hosting economics. It also necessitates staying abreast of technological advancements and market trends. By carefully analyzing these factors, investors can navigate the inherent volatility of the mining hardware market and potentially unlock significant returns.

Consider the evolving landscape of Ethereum. While the merge to Proof-of-Stake (PoS) has diminished the demand for Ethash-based GPU mining rigs, it has simultaneously opened up new opportunities for alternative mining algorithms. Coins like Ethereum Classic, which continues to use a PoW mechanism, have seen a surge in mining activity, potentially revitalizing the demand for certain types of mining hardware. This dynamic illustrates the importance of adaptability and forward-thinking in the ever-changing world of cryptocurrency mining.

Effective risk management is also paramount. Diversifying investments across different cryptocurrencies and mining machines can help mitigate the impact of market fluctuations. Regularly monitoring the profitability of mining operations and adjusting strategies accordingly is crucial for maximizing returns and minimizing losses. Furthermore, factoring in the potential for regulatory changes and technological disruptions is essential for long-term success.

In conclusion, investing in mining machinery is not a passive endeavor. It requires active participation, diligent research, and a willingness to adapt to the ever-changing landscape of the cryptocurrency market. By understanding the intricacies of market price fluctuations, technological advancements, and hosting economics, investors can transform the art of mining machine investment into a rewarding and profitable venture. The key is to view the market not as a chaotic storm, but as a complex and dynamic ecosystem, ripe with opportunity for those who are prepared to navigate its currents with skill and foresight.