In the rapidly evolving landscape of cryptocurrency, mining remains a cornerstone activity driving the relentless expansion of digital finance. Yet, as the complexity and energy demand of mining operations grow exponentially, so does the need for smarter, more efficient power solutions, especially in the domain of mining machine hosting. Whether it’s the feverish extraction of Bitcoin (BTC), the diverse mining of Ethereum (ETH), or the dogged pursuit of altcoins like Dogecoin (DOG), the pulse of mining rigs depends on a robust, intelligent power infrastructure.

Hosting mining machines extends far beyond simple hardware placement; it demands a meticulous orchestration of power management, thermal regulation, and network stability. Traditional mining farms—often sprawling collections of miners—require power solutions that not only deliver raw energy but also adapt dynamically to fluctuating loads and operational variables. The smart power solutions tailored for hosting environments incorporate cutting-edge technology such as automated load balancing, predictive energy distribution, and real-time monitoring systems, which together mitigate downtime and maximize hash rates across the entire rig ensemble.

Consider Bitcoin mining, for instance, a process notorious for its vast consumption of electricity. As the difficulty ramps up, miners scramble to secure higher computational throughput by deploying more ASIC (Application-Specific Integrated Circuit) miners. These devices, while incredibly powerful, demand steady and efficient energy input. Smart power systems address this by integrating renewable energy sources, battery buffering, and intelligent grid interaction to ensure uninterrupted supply even during peak demand periods. Moreover, by implementing advanced cooling solutions alongside intelligent power management, mining hosting providers curtail energy waste – a critical factor in maintaining profitability in volatile crypto markets.

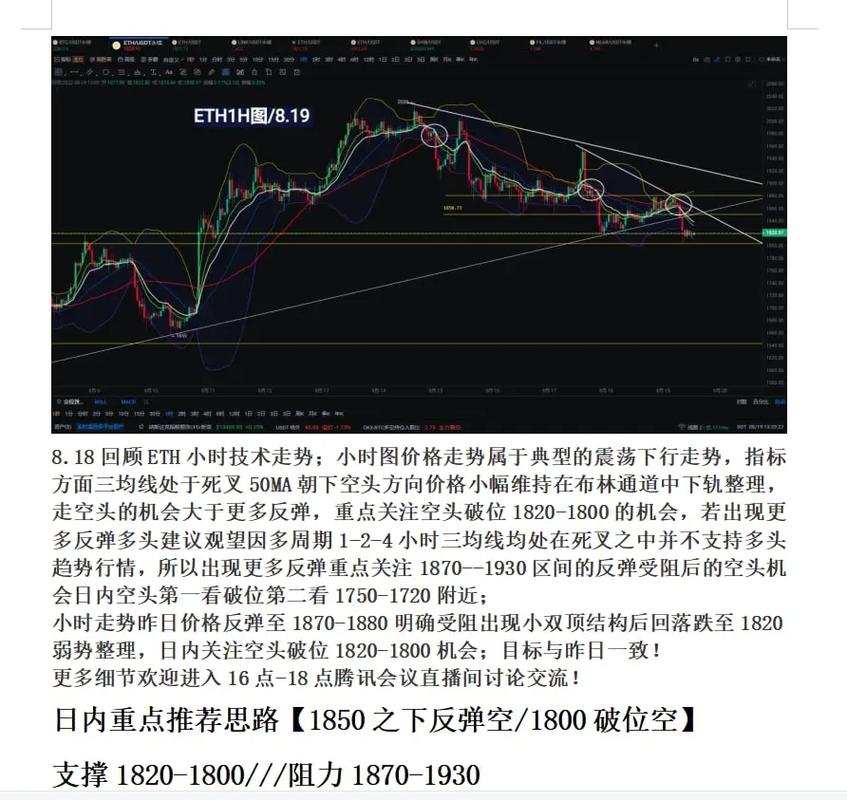

Equally, Ethereum mining setups possessing GPU-heavy configurations face unique power challenges. Unlike ASIC miners, GPUs have a more varied power draw and heat emission profile, making smart power solutions indispensable. Beyond the electricity metering, these solutions often include AI-driven predictive analytics that anticipate maintenance needs or detect efficiency drops, minimizing operational risks. Hosting facilities leverage this intelligence to reduce costs and enhance longevity of mining rigs, turning power management into a strategic asset rather than a mere overhead.

Dogecoin mining, on the other hand, typically coexists with Litecoin (LTC) due to merged mining schemes, requiring flexible power arrangements allowing simultaneous multi-algorithm support. Here, modular smart inverters and scalable power units come into play, catering to a kaleidoscope of mining strategies with minimal manual intervention.

Mining farms have rapidly matured into sophisticated ecosystems where power efficiency equates to competitive advantage. Leading operators integrate smart meters, IoT-enabled power distribution units, and AI-powered energy management platforms. These solutions deliver granular visibility into power consumption patterns for every miner, enabling rapid decision-making to optimize throughput and reduce the carbon footprint. Furthermore, hosts of mining machines now utilize dynamic pricing models for electricity costs, leveraging blockchain technology itself to automate payments and settlements with power providers—an elegant intertwining of cryptographic innovation and energy economy.

In the realm of exchanges and broader cryptocurrency ecosystems, smart power solutions impact more than just the backend minting of tokens. They indirectly stabilize network security, as miners are incentivized and enabled to maintain continuous operation. This importance scales dramatically with market fluctuations: during bullish phases, miners deploy additional rigs demanding dense, responsive energy grids, while bearish cycles accentuate the necessity for cost-effective, scalable power systems to preserve capital reserves. Thus, smart power solutions underpin the very heartbeat of crypto mining, offering resilience amid unpredictability.

Ultimately, the trajectory of cryptocurrency mining machine hosting is inextricably linked to innovations in power architecture. The symbiotic relationship between miners, their machines, and the power solutions that energize them is a dynamic ballet of technology and strategy. Harnessing smart power not only fortifies operational stability but also pushes the frontier of sustainable mining—a crucial step toward legitimizing and preserving the vast blockchain ecosystems that have redefined the financial world.