In the rapidly evolving landscape of cryptocurrency, Bitcoin mining remains a cornerstone activity driving the entire ecosystem. For enthusiasts and professionals alike, finding the best Application-Specific Integrated Circuit (ASIC) miners in the USA is imperative for maintaining competitive operations. Unlike general-purpose processing units, ASIC miners are meticulously engineered to perform a single task: hashing Bitcoin’s SHA-256 algorithm with unrivaled efficiency. As the decentralization of mining continues, understanding which ASIC models offer optimal power consumption versus hash rate can dictate profitability and long-term viability in the American market.

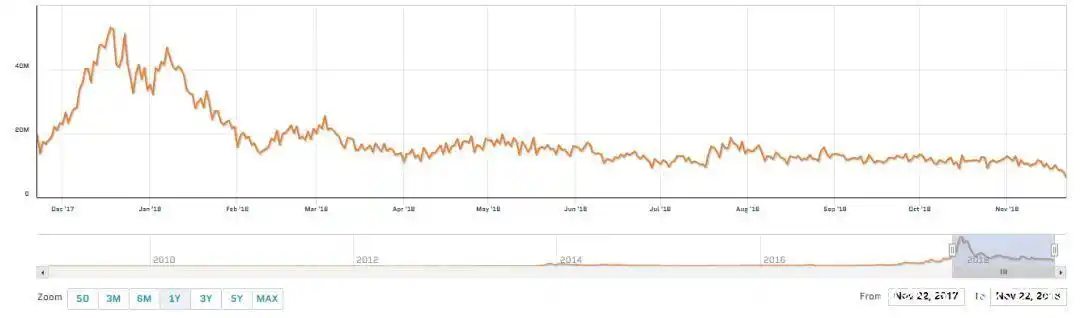

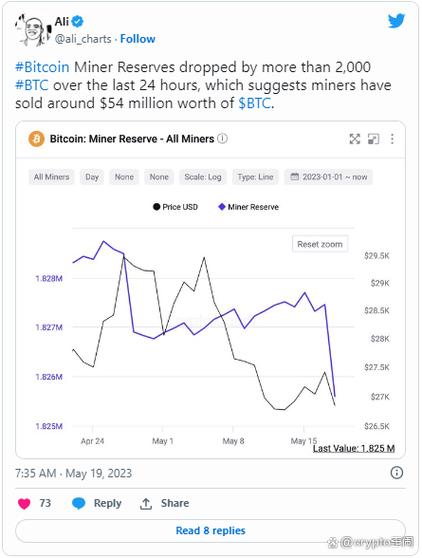

At the heart of Bitcoin’s blockchain validation process lies these powerful ASIC rigs, which have rendered traditional CPU and GPU mining all but obsolete. Each miner functions as a specialized puzzle solver, contributing computational power to secure transactions and mint new bitcoins. The fierce race to acquire the most efficient machines is intertwined with the ever-fluctuating difficulty of mining and electricity costs, which vary significantly across regions in the USA. Areas with inexpensive power grids, such as Texas and the Pacific Northwest, attract numerous mining farms that capitalize on low kilowatt-hour prices, providing a fertile environment for hosting ASIC miners.

When considering ASIC options, models from companies like Bitmain, MicroBT, and Canaan strike a balance between hash rates and operational expenses. Bitmain’s Antminer series, such as the Antminer S19 Pro, boasts hash rates exceeding 110 TH/s, making it a coveted choice among US-based miners. Meanwhile, MicroBT’s WhatsMiner M30S++ delivers competitive performance with slightly lower power consumption, appealing to those who run operations where electricity costs are a critical factor. Additionally, emerging ASIC providers are constantly innovating, introducing smaller footprints and enhanced cooling systems suitable for domestic miners or small-scale hosting services.

The proliferation of mining farms in the USA has also transformed how individual miners access and utilize ASIC machines. Hosting services now offer turnkey solutions where miners can lease space, equipment, or cloud mining setups, mitigating the need for direct hardware management. These mining farms provide robust infrastructure, high-speed internet connectivity, and round-the-clock maintenance—elements crucial to maximizing uptime and hash power. It’s an enticing option for individuals or institutions seeking exposure to Bitcoin mining without navigating the complexities of hardware procurement and operation themselves.

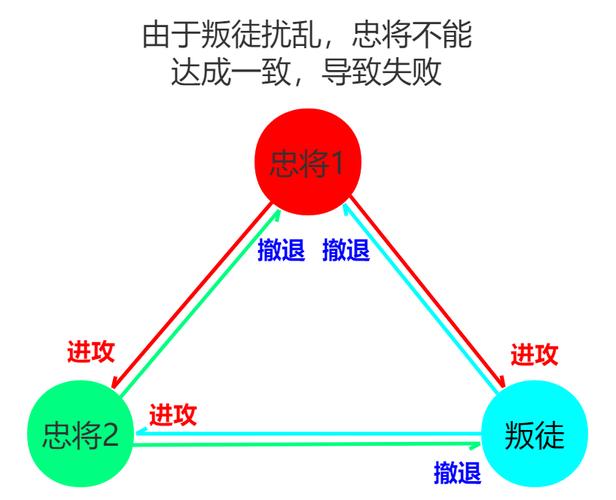

Beyond Bitcoin, the crypto space abounds with numerous altcoins requiring different mining apparatus. Ethereum mining, for example, traditionally relies on GPU rigs, though its imminent move to Proof of Stake alters the mining narrative drastically. In contrast, Dogecoin (DOGE), initially a joke coin, has surged in popularity and is often mined through merged mining alongside Litecoin. This process allows miners to simultaneously secure multiple blockchains without additional effort or substantial power increases, showcasing the versatility and cross-chain benefits that some mining operations leverage.

Cryptocurrency exchanges play a significant role in complementing mining activities by offering seamless avenues for miners to convert freshly mined tokens into fiat currencies or alternative digital assets. Platforms like Coinbase, Binance US, and Kraken provide liquidity and security, enabling miners to rebalance portfolios or reinvest proceeds into purchasing upgraded mining rigs or expanding hosting contracts. Such integration forms a symbiotic cycle where mining hardware acquisition, coin production, and asset management intersect fluidly within the evolving crypto economy.

The future trajectory of ASIC miners in the USA is tethered not only to technological advancements but also regulatory and environmental considerations. Policymakers weighing energy consumption implications could influence where and how mining farms operate, prompting shifts towards more sustainable energy sources or incentivizing carbon-neutral practices. Consequently, miners, whether individuals or corporate entities, must stay abreast of these dynamics, adopting strategies that incorporate energy-efficient hardware and sustainable hosting solutions to thrive in an increasingly conscientious market.

Innovations like immersion cooling, renewable energy integration, and AI-driven mining management software promise to reshape the mining landscape, pushing ASIC miners to new heights of efficacy and profitability. For those navigating the labyrinth of options, a keen understanding of specifications, power capabilities, and operational environments is paramount. Selecting the right ASIC miners and associated hosting services can unleash unparalleled growth, forge competitive advantages, and cement a prominent position in the complex yet rewarding world of cryptocurrency mining.